The City of Hillsboro is considering adopting an ordinance that would amend the North Hillsboro Industrial Renewal Area.

Join us at this Open House to learn more about the proposal, review the draft Industrial Renewal Plan and Report Amendment, and talk to staff.

Proposed North Hillsboro Industrial Renewal Plan Amendment 2023

North Hillsboro remains one of the few industrial development opportunities in the region with the potential to meet the region’s needs - and community’s vision - for job creation and economic growth.

To fulfill this vision, the area requires necessary public infrastructure to attract and drive private investment in new facilities, equipment, and jobs.

Plan Amendment

Since the adoption of the original North Hillsboro Industrial Renewal Area, the City has continued to plan for new industrial development in the Jackson east area, allowing for economic development.

Since the adoption of the original North Hillsboro Industrial Renewal Area, the City has continued to plan for new industrial development in the Jackson east area, allowing for economic development.

The proposed expansion area faces the same challenges to industrial development as the land in the original boundary.

These needs include:

- Connected transportation system with multimodal capacity

- Utilities including water, sewer, storm water, and other public services

- Trails and open space improvements

- Natural resources enhancements and environmental sustainability

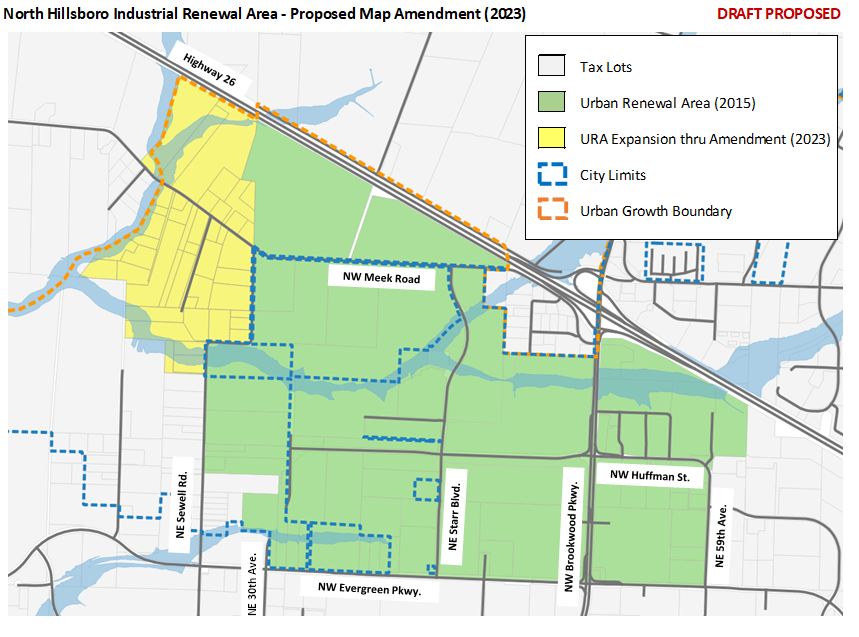

The City is proposing to expand the existing boundary to address the industrial site readiness challenges in this area.

Existing Plan:

- Size: 1,090 acres

- Maximum Debt Capacity: $224 million (with inflation factor)

Proposed Expansion:

- Size: Approximately 200 additional acres

- Additional Debt Capacity: $44.8 million (forecast)

Total Plan (Existing & Proposed)

- Size: 1,303 total acres

- Maximum Debt Capacity: $268.8 million total

The boundary expansion will give the City the ability to increase acreage, include additional urban renewal projects (infrastructure, transportation connections, natural resource enhancements, trails and open space), and increase the total amount of funds available for improvements through tax increment financing.

Tax increment is a financing tool which sets aside new property taxes generated from businesses within the boundary, offering the same potential of bringing new high investment, high employment, high wage industrial users to the state's pre-eminent technology hub.